Environmental Social Governance (ESG) Investing

Environmental Social Governance (ESG) is all the rage, at the moment. ESG is an approach to investing which claims to focus on the environmental and social impact of a company or companies activities. The approach also claims to renew the emphasis on good governance (a proper and accountable process of making decisions) as a key determinant of investment eligibility. The ESG credo is to invest in companies that do good in every way, I suppose.

Elsewhere on this website, I have told the story of the Greedy Farmer name, and true, it is a little tongue-in-cheek. On the other hand, the word greedy is an honest representation of my investing philosophy. An honest, critical, clear-eyed view of the world may be the most important aspect of investing.

The Greedy Farmer also notes, being greedy when you invest does not take away from your ability to be generous outside of investing, it actually makes you more able to do good. Just as a great rugby player plays to win, that does not make her any less likely to pick a beat-up opponent off the turf at the end of a play.

What Does This ESG tab Have to Do With The Greedy Farmer Investing Approach?

Like a lot of the website, you don’t have to read any of this ESG discussion to copy my investing strategy. If you stick with my Buy / Sell trading alerts, keep track of your portfolio as you build it, and maybe look at my portfolio detail, periodically, that is all you need to do. What this tab does is provide my view on the world, however. I believe a healthy level of skepticism is important to be good at investing, long term. You may already have that, and that skepticism may have led you to this website and away from the comfortable, reassuring hug of a big institution. If not, if you generally trust the established institutions, maybe this ESG discussion will offer you new perspective.

Since I am lecturing you to be skeptical and critical, why not be skeptical of The Greedy Farmer? Because I am a farmer, everyone knows farmers are honest?

NO!

Trust me because I am disclosing my actions. You can just as easily check my record by doing the same math as I do. I show you every trade I make, all the information is there.

And now, a cautionary note and then you should be fully prepared for the remaining reading. Some of the following is detailed and s l o w m o v i n g. There is some boring subject matter and there are limitations to my writing ability. On the flip side, some of the content is easy to read, logical, and I even have hopes that some of it is interesting. In other words, the reading experience will vary. Don’t judge it all by the upcoming definition section which kicks off the discussion.

What Are Capital Markets?

Before we plunge into the ESG discussion, let’s review what capital markets are and what they do:

Capital Markets: these are the financial markets where debt and equity securities trade.

Debt securities include the bond market. Bonds allow you to lend money to a company (corporate bonds) or a political jurisdiction (government bonds). When you purchase a bond, you are providing funds to the issuer of the bond, and you receive a fixed interest payment on a regular basis thereafter (hence the term “fixed income”) until the end of the term. At the end of the term (or maturity of term), you also receive back your original funds (the principle).

Equity securities (also known as stocks or shares) provide you, as an investor, an opportunity to buy a portion of a company. Again, you are providing funds to the company, this time in return for a slice of ownership, and a share of potential future corporate profits.

This is what capital markets allow. They allow opportunities for savers to lend or to invest in exchange for a future / potential economic gain. This, on the surface, is a very simple function. It gets more complicated when you add in issues such as various types of risk, the term of the investment, and taxation.

To use the wording of the Economist magazine, “Masters of the universe”, October 5th, 2019: “The job of capital markets is to process information so that savings flow to the best projects and firms.”

As investors, we need to process information to ensure benefits to us, the individual, are greater than the costs we incur, and risk of loss needs to be part of that analyses. As an individual investor, that is our job.

Proponents of ESG investing claim you can make your best risk adjusted return (investing profit) by investing in securities that are designated as ESG compliant or rated highly by ESG rating institutions. They argue you can invest in companies or funds that “do good” and when you align with those who do good, you are reducing your long-term risk. Your ESG investment will outperform and make the world better, they argue.

I will argue against this ESG premise. I will argue ESG adds complexity and blurs an already fuzzy world. I further argue ESG investing directs you to put your faith in a small group of self-appointed experts who claim to know better. So that is what this discussion is all about. While it seems I am picking a fight for the sake of fighting, think about who gets hurt if ESG raters miss their mark… you, me, pensioners, regular people. Please keep that in mind as you review my scrutiny.

Why Criticize Environmental, Social and Governance (ESG) Investing?

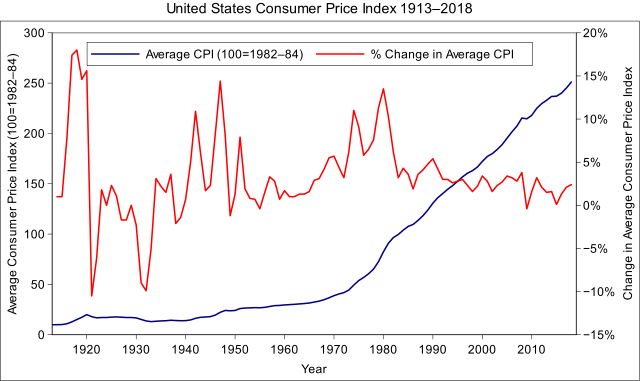

Frankly ESG just feels fake. It is like the happy face of the actor you see sitting in a dentist chair in those health insurance ads on television. That face makes you feel good, but at the same time your subconscious is revisiting an experience where a dental drill got too close to a nerve. Too much of personal finance is like this. How often are people shown graphs that go up and to the right* without an accurate explanation of your actual investing performance in a manner you understand? There is too much focus on new and exciting investing trends and not enough is about actual results; ESG is another example of that. Trends such as ESG investing grab headlines for years at a time, but do such trendy topics make you any money?

By Original image by User:donarreiskoffer, new SVG version made with Gnumeric (from BLS data; now covers 1913–2018) – Data source at [1], specifically in the “… index averages” table in this PDF file (US Government – public domain); Original image at Image:Consumer Price Index US 1913-2004.png, CC BY-SA 3.0, Link

In the content below, I break ESG investing down into a few topics and review some faults. My conclusion after this review, ESG validates The Greedy Farmer’s role. There is no reason I should outperform a financial adviser at a big bank, when you consider their resources. Why I do is because I am not influenced by the need to sell in-house financial products (ETFS, mutual funds, other). The established financial industry does bear that burden, is driven by the need to sell their products, to compete for your attention, and maybe even to distract from their mediocre results. Additionally, at a time of ever lower fees, ESG funds provide a way for a fund to justify bumping this fee. These motives, unfortunately, is what drives the ESG trend.

To review, The Greedy Farmer is driven by investing results. My goal is the same as your goal, “make money; don’t lose money”. This alignment of goals is what is important.

Now that you know why I am spending a lot of space on the topic, here is the plan: I will start by defining what ESG claims to be, and then go on to suggest that:

- supporting the ESG movement as it is today, is supporting bad behaviour;

- I’ll briefly explain Greenwashing;

- I will review 3 economic activities two of which are often targeted for exclusion from ESG investment portfolios (beef production and oil & gas production) and an economic activity that seems to stay below the radar (gold production);

- finally, I’ll acknowledge that ESG is likely here to stay and make some concluding comments from my perspective.

How is ESG investing defined?

ESG is defined as investing in funds or companies which practice sound environmental, socially responsible activities; organizations that use good governance to accomplish positive outcomes. Other variations on this theme include SRI or Socially Responsible Investing, Impact Investing, Socially Conscious Investing, Green Investing, or Ethical Investing… there are probably more.

Wait, so that all sounds quite good! Why the lead off that trashes such a wholesome sounding process, you ask? Hold on, I’ll get to that soon, let’s continue with the definitions. You will quickly see, actions don’t match the words.

So, to recap ESG Investing encourages investment in companies whose activities are guided by the three key elements of ESG:

“E” for environment – minimize pollution and the impact on the environment. To some extent, this ESG factor is self explanatory.

“S” for socially responsible – make a positive impact on people, employees, the community, society.

Let’s talk a bit about how this factor is defined. One source, a United Nations group, has published a document named, Principles for Responsible Investing1. The forward in the document defines the social factor as follows: human rights, labour standards, gender equality. Nowhere in the 35 page, fine print document does the word democracy appear. China is referenced 11 times, democracy is referenced zero times.

So two issues here: first, democracy is the ultimate hard-fought right that that belongs at the top of any social scale. Second, the U.N. document does make an issue of investment risk related to potential riots and social unrest because of corporate bad behaviour, but omits the equally important risk of such unrest as a result of a closed and undemocratic government. The Arab Spring, the Hong Kong riots, Russian riots, Kenyan and Egyptian unrest all presented far more risk to investment than a Canadian, American, or British election. If ESG is serious about measuring this risk, they need to consider how much business a company such as GM or Microsoft carry out in China or Egypt, for example; what risk is Apple taking on by bending to Russian pressure and re-configuring their map application to make Crimea appear to be part of Russia in lieu of Ukraine? Such issues are incredibly complicated but claiming to rate companies on their social conduct while ignoring the issue of democracy is hypocritical and ignores a large risk factor. An absence of openness and democratic process has created endless unrest, social disfunction, and economic cost. As in-control as China may seem, maybe they are only a recession away from riots when economic growth is no longer buying off the discontent over the lack of liberty?

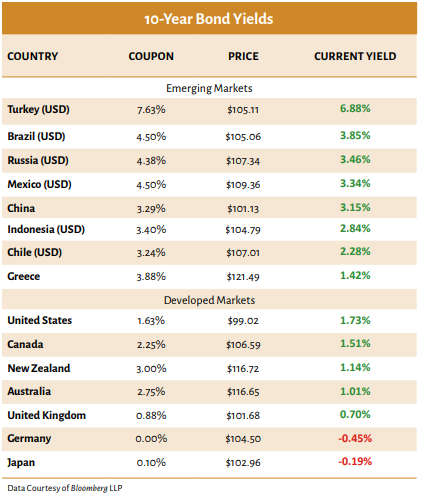

There are others that point to the importance of democratic rule to investment returns. A feature in the Q3 Market Update on Liberty International Management Inc.’s website is as follows, “So, you want to be a dictator, do you? In the table below, note that emerging market countries, essentially those led by dictators, have to pay the highest rates to cover the risk of non-democracy.”2

I note, it is a stretch to say all the emerging countries listed are run by dictators (certainly Turkey, Russia, and China are), but I’ll agree with the Liberty International authors, all the countries listed bear the risk that comes with either a lack of democracy or less developed institutions and a shallower history of democratic traditions. This reinforces my point, if ESG is a serious movement and the “S” component matters, ESG needs to recognize quality of democracy as a long-term investment risk factor and as an important investing factor if you believe investing in places that do good, matters to you.

Note: in the chart above, the “Current Yield” is the yield or interest paid to the holder of the respective country’s 10 year government bond. Higher interest is generally demanded, by the bond market, where the risk of default on repayment is higher.

“G” for governance – ensuring accountability, fairness, transparency among all stakeholders.

This ESG factor is confusing. To the extent “G” or governance is an ESG priority, that is good. The confusing part, governance is and has always been a fundamental role of corporate boards, by definition.

The directors which make up a corporate board, have a duty of good governance to their corporation. They must act honestly, in good faith and in the best interests of the venture. In other words, a corporate board must provide governance, that is what they do. This is not a new responsibility.

The point being, since all boards must make governance their reason for being, a fund company should only invest in companies that practice good “G”.

This begs the question, before ESG became all the rage, were banks, mutual fund companies, investment firms not evaluating “G”? As for the majority of the ETFs and Mutual Funds which are not designated as ESG, should we be worried that “G” is being overlooked? That is a question to be asked of your financial advisor, I suggest.

Let’s wrap up this discussion with a definition provided by Questrade, which is one of Canada’s more popular robo-advisors, as presented on their website. The Questrade example shows how fuzzy the “do – good” investing trend is:

“For Questwealth SRI portfolios, as there is no universal Socially Responsible Investing (“SRI”) methodology, the selection of the underlying securities in the Questwealth SRI portfolios is based on inputs from various industry sources, including Environmental, Social, Governance, and SRI methodologies. Certain portions of the fixed income component of the Questwealth SRI portfolios may not be recognized by these methodologies as exclusively SRI. “

I don’t know what that means, do you? In addition, I can’t find the performance record of the SRI funds. All I see is more talk about low fees. You would think fees are all that matters.

1 An investor initiative in partnership with UN Environment Programme Finance Initiative and UN Global Compact, 2017

2 Liberty International Management Inc., September 2019

Bad Behaviour Shouldn’t Be Supported

If investors decide ESG investments are uniquely good and worthy of investing, let’s hope they peel off the cover on the investment and look inside at the contents. To be uniquely good, an ESG ETF needs to hold uniquely good companies. On closer inspection, many ESG investment funds appear to include a lot of companies that many other “regular” funds hold. Such ESG funds invest in mainstream tech companies such as Microsoft, for example, which serve customers from school teachers to miners to autocrats and drug dealers. The same fund may have a sprinkling of water treatment companies and renewable energy companies, for example, and they use these minor holdings to claim to be uniquely ESG. This is referred to as greenwashing and I have an example of an ETF that represents this approach coming up.

Worse than the deceptive act of greenwashing, is the idea of making investments in companies which support activities explicitly exempted from the investment criteria of the fund. Fossil fuel production is often the activity labeled as bad, by ESG investment funds. An example below is of a fund which avoids fossil fuel producers but lists as a top ten investment a company which provides services to fossil fuel producers. Is that really different? In these cases, rather than ESG being a force for transparency, it is helping to obscure the truth and that is bad behaviour. Regardless of your beliefs, whether you support fossil fuel production or not, transparency is a bigger issue. Don’t say you are something you are not, “Mr. fund manager”. I am arguing that by supporting ESG, you are likely reinforcing this kind of bad behaviour. Check out the examples below and see if you come to the same conclusion.

Greenwashing

Greenwashing, as noted above, is a term which describes a company or an ETF or a mutual fund which claims to be green or ethical or socially beneficial when it is not, to a significant degree. Greenwashed funds use ESG factors to take the investor’s focus off performance under the guise of doing good, I suggest.

There are lots of ways to do good with your money, dozens, maybe hundreds of charities you can support, for example. No good comes from a fund that only pretends to do good, whether it is labelled ESG or not.

Now for the examples. I looked at the Fund Facts document on a couple of ETFs that are highly rated according to some self-appointed Canadian ESG expert types. I have included the links to the Fund Fact pages, in case you want to look on your own:

Northwest and Ethical Investments LP (NEI) is an example of an ESG fund which avoids fossil fuel investments, according to the fund brochure. I looked at the Fund Fact sheet and notice the number two holding is Linde. Linde is a supplier of gasses for hydraulic fracturing for the completion of oil and gas wells and for infrastructure purging (again, pipelines and gas plants, etc.) Does NEI not know this, or they didn’t look, or it is arms-length so it is okay? The activity raises questions about the purity of the no-fossil-fuel mandate, right? That is my main point but I would like to also take the opportunity to question the “no” fossil fuel mandate as well.

Is it even possible to avoid fossil fuels when they are a part of almost every aspect of our lives? From the shoes we wear which are bonded together with petrochemicals, to the vinyl flooring we walk on, the pipes which carry water to our homes and sewage away, and the food we eat – which is seeded and transported with fossil fuel powered machines, fossil fuels are integrated into every aspect of our lives.

Let’s not forget fossil fuels are part of carbon reducing solutions, as well. Petroleum based plastics make up a large part of the fuel efficiency-improving, weight-reducing components of new cars including electric ones. Additionally, petrochemicals are used to make the composite material that make new jet aircraft so much lighter. Bitumen is an affordable, quality highway road material ingredient and we have thousands of miles of this fuel saving product to drive on. Drive on a soft, wet gravel road some time and consider how much fuel you are saving thanks to bitumen-based asphalt. As an aside, I recently watched an organic farmer burn weeds with a propane flame in lieu of herbicide application. Every alternative practice has a drawback. Even if we quit burning fossil fuels for electricity and transportation, we still need the stuff!

Back to the Northwest and Ethical Investments LP fund. The fund mandate which does not allow investments in oil and gas production presents a questionable benefit to society. It is especially questionable since only a portion of oil and gas is burned, much is used to make things we use every day. It is also worth noting, while combustion of oil and gas pollutes, without question; avoidance of local production does not reduce pollution at all. This is especially true if local (or national) production is cleaner than foreign production and if production is simply meeting demand that exists. To this extent, combustion pollutes, production does not.

There are more thoughts on related topics from others, “Fossil Fuel Divestment Has ‘Zero’ Climate Impact”, says Bill Gates in a recent Financial Times article.

Of course, the main point of the last topic, is the hypocrisy this ESG fund demonstrates. They do not invest in fossil fuel production, yet they invest in companies that support that same production! That is a problem, if transparency and integrity matters. Hypocrisy is not a basis for ethical investing.

Northwest and Ethical Investments LP (NEI) Fund Details:

Fund ticker: NWT088 (3) year performance to end of August 2019 = 6.0%

Greedy Grower (3) year performance to end of August 2019 = 6.7%

Greedy Grower is out-performing by 12% (0.7/6.0 = 12) => a longer comparison would be better but the fund hasn’t been around long enough.

ESG Fund research number two:

I read, in the AGFIQ Enhanced Global ESG Factors ETF brochure, defense industries are avoided. Does that solve something? I don’t know of a country in the free, democratic world that believes we don’t need a military and defense equipment to arm it. Even the countries which are neutral have guns and fighter jets. This approach to investing is confusing. That’s the first bone I have to pick.

Onto the next criticism… the eighth largest holding is the booze producer Diageo PLC. One knows that a whisky or ten never caused any havoc! On second thought, and I’m no teetotaler, but I wonder which product has caused more misery, booze or bombs? I guess it comes down to your own personal beliefs. No, actually, it doesn’t. It comes down to the beliefs of the fund manager, you are just along for the ride!

Criticism number three takes us back to Greenwashing. According to the fund facts document which lists the top 10 holdings of AGFIQ Enhanced Global ESG Factors ETF, you find Microsoft, Siemens AG, Alphabet Inc., Verizon Communications Inc., CVS Health Corp., Toronto-Dominion Bank, Bank of America and more. Do these holdings make them “greener” than other funds? How many of these industries or companies conduct business in the areas the fund claims to avoid? I’m sure both Microsoft and TD Bank do business with oil companies. “Bovine Stool investing” = ESG investing, that’s just my thought, in case it isn’t obvious.

AGFIQ Enhanced Global ESG Factors ETF Details:

Fund ticker: NEO-L:QEF the fund hasn’t even been around for a year so the performance is quite meaningless although it appears to track the S&P 500 so far this year, which makes sense when you look at its top holdings. I don’t know how a fund around less than a year is “highly recommended”. I refuse to disclose who recommended this fund. They don’t deserve exposure.

Why Cattle Ranching Doesn’t Deserve to be the Whipping Boy

I chose this topic as it really speaks to the other danger of the ESG movement, which is the opposite of greenwashing. What if good activities are misunderstood and are labeled as bad? Now you, as an investor, are not benefitting from a positive investment. Additionally, there is the chance consumers and regulators are wrongly influenced by the ESG people. An industry wrongly labeled by some ESG fund managers is the beef production industry.

Beef production gets the squinty eye from people for several reasons. For one, some people believe all agricultural land should be used for growing plants that people eat, not for growing plants that animals eat. Secondly, there is a widely held opinion that cattle are a significant source of methane which is a greenhouse / climate change causing gas. As a result some ESG funds including the U.S. Vegan Climate ETF, NYSE Arca:VEGN, exclude meat producing or retailing businesses.

Let’s take a deeper look at beef and crop production. Feel free to complete your own homework but here is my understanding of the industry and the issues:

A lot of the land used for raising cattle is natural grazing or pastureland. The soil or weather is not ideal for raising vegetable or cereal crops (human food) on this land. Some of this land has very shallow, thin, sometimes silty soil which would blow away if cultivated for crop farming. A lot of this land was historically grazed by bison which kept shrubs and trees at bay allowing grasses an opportunity to thrive. Cattle now do that job and maintain the grazing land for the natural habitat of burrowing owls, ground squirrels, badgers, mice, red-tailed hawk, fox, coyote and more, depending on the region. It was interesting to see the CBC’s, The Nature of Things recent program acknowledge the important role cattle can play.

A lot of cattle spend a significant part of their lives grazing on such land. The months when they are fattened in a feedlot, they are often fed grain mixed with grasses and forage crops to match the meat more closely to people’s tastes. Grain farmers who, in The Greedy Farmer’s region, grow canola and wheat which are “people” foods, sometimes are hit with bad weather. Bad weather damages the crop and some years the wheat is downgraded to feed quality. This means no one will buy it to make bread. It would be an economical disaster (and real waste of food) if we didn’t have an animal feed market to sell that downgraded wheat into. That animal feed market includes hogs, chickens, turkeys, as well as beef and dairy cows, sheep, goats and other animals.

How all these arguments play out in Northern Ireland, the Brazilian rain forest, Southern China? I don’t have a clue. I’ll bet your ESG fund manager doesn’t either.

Another crop that really grows well in our region is barley. Some of that is grown for beer production, some for food ingredients such as pearl barley for soup, a lot for animal feed. Importantly, barley is part of a crop rotation program that helps keep weeds and disease confused. Yeah, confused isn’t the scientific term but it describes the role of crop rotation well. If you grow the same crop on the same land back to back years, soil and plant diseases become well established, as do certain weeds. We don’t really have the option to only grow wheat for bread, for example. We really need to grow 3 different crops, at a minimum, to keep everything healthy. It’s all simple until you learn enough to know it isn’t.

Canola is an important human food crop which also does well in our region. It is sought after thanks to the high mono-saturated fat content, making it one of the healthier vegetable oils. As a member of the cabbage / cauliflower vegetable family, it only makes sense that Canola has some health attributes. Canola oil has the added attribute of a high smoke point meaning it is not chemically altered until it is exposed to a very high temperature. This makes Canola very popular in deep fat frying and other cooking applications. The cool Canadian aspect is that Canola was developed from the rapeseed plant through plant breeding by scientists in Canada. The breeding program selected for specific traits to produce oil which has the highest portion of good fats and the lowest portion of bad fats of the vegetable oils. Since the development of this product occurred in Canada, it just made sense to name it Can-Ola, Canadian Oilseed… right?

Canola is grown worldwide but Europeans choose to call it rapeseed oil. That’s okay with us, if they want, they can wear trousers instead of pants too.

In addition to vegetable oil, which makes up about 44% of the seed, Canola seed has another component known as meal. Meal makes up 56% of a canola seed. Meal is a high protein feed product which is fed to cattle, poultry, hogs and other animals. Again, the animal feed aspect to human food production economics is very important.

What if we lost the animal feed market? I imagine local farming activity would be radically reduced. Alberta would lose our second largest export category, we would have to import most of our food. So much for the 100 mile diet, or is that still a thing?

Just to recap then: beef is often grazed on land that doesn’t grow human food, animal feed crops are needed as part of a rotation program that helps to protect the land from disease and weed infestation, feed crops ensure the economic viability of human food crop production. In conclusion, it is a food production system. The system does change over time, it can and does evolve but it isn’t simple.

Not all of The Hot Air Comes From The Back of a Cow

Darn, I got so wrapped up in the Armageddon-of-the-farm talk I forgot about methane, climate change and cow farts… Let’s tackle that, it seems like a natural transition. Speaking of cow farts, let’s begin this with some CBC radio output. Recently, during a question and answer segment on CBC’s Quirks and Quarks program, a Canadian animal bioscience professor said something interesting. She said, “Decomposing plants also release methane but no more or less than cows” Wow, quite the statement! Here is the link so you can view or listen to this discussion first hand:

That is interesting stuff! Not a week goes by that someone doesn’t point their finger at beef production as a contributor to climate change. It begs the question, if your ESG investment fund avoids meat production or retailing, who are they serving? What other bad decisions are they making related to other industries?

Grass Farting

Okay, grass doesn’t fart. All that means is that grass is sneakier than a cow. It doesn’t make grass better.

To repeat what the bioscience professor stated, the bacteria in the gut of cattle do create methane when they break down the grass, just as bacteria in rotting grass in a meadow produces methane. Further, if we did shut down beef production and gave some of the grazing land back to wildlife, how would that change things? Bison, deer, antelope, elk… all have similar digestive systems to cattle and create methane as well, not sure we want to rid the earth of them. It should also be noted, just like your lawn, when pasture or grazing grass is clipped whether by teeth or a lawnmower blade, the plant grows additional leaf instead of going to seed. This additional growth requires the consumption of carbon dioxide by the grass plant. Maybe these processes balance out, I won’t claim to know all the math on this.

There is also the water discussion. I have read one estimate that it takes 1700 gallons of water to create a pound of beef. Apparently, the cows studied don’t pee! Wouldn’t it make sense that almost every gallon that a cow drinks ends up back on the ground? Who comes up with this stuff?!

The Cow That Didn’t Pee

Of course the water required, according to the research, includes all of the water needed to grow the grass and the grain as well. How does that work? Here is a scenario: it rains on our grain fields, the barley grows, we harvest. The grain we ship has about a 14% moisture content. A cow may eat that grain in a Southern Alberta feedlot and, after she pees, the water evaporates or is spread on the land for fertilizer for local crops. Either way, the water ends up in a cloud, if we get a Southeast wind, we may get that water back, otherwise we share it with Saskatchewan.

I know that water discussion sounds a bit cheeky. I do think it will stand up in the court of science. That’s not to say every jurisdiction is the same. I should note, most grazed or feedlot fed cattle in Alberta are watered from creeks, rivers, and dugouts. Our Alberta irrigation systems, which support agriculture in the South, are amazing systems which do so much to benefit the economy in Alberta. These are creek and river fed systems. Cross jurisdictional agreements are in place to make sure an agreed minimum of river water flow into neighbouring regions, such as Saskatchewan.

Irrigation areas such as Kansas, however, rely heavily on an aquifer source for much of their water. The High Plains Aquifer System, to be exact:(https://en.wikipedia.org/wiki/Ogallala_Aquifer) There may be a debate about sustainability worth having down there but that is a very different situation than we have in Alberta. I suspect the Kansas debate should focus on matching use of the aquifer water to the replenishment rate and allowing the markets to determine what the use is. Bureaucracies don’t do a great job of managing scarce resource. Just ask a Newfoundland cod fisher or a Westcoast salmon fisher!

Before I finish this farm talk, we need to look at some numbers. Numbers seem absent from a lot of discussions. Do journalists and writers hate math? That is a real problem because few things are purely good or purely bad. Generally, quantity matters. What did the 1970s rock band, Sweet sing, “Love is like oxygen, you get too much and you get too high, not enough and you’re going to die…”

What happens when you don’t include the math? The argument trends toward a binary choice = 100% one way or 100% the opposite, everything black or white when reality is made up of shades of grey.

Applying mathematics to agriculture and carbon intensity, based on first-hand knowledge, goes like this: our carbon footprint, on our farm continues to shrink. We produce so much more with so much less fuel, than in decades past. A LOT MORE. When I was a kid, we produced 360,000 pounds of barley per ½ mile by ½ mile = a quarter section of land. Today we produce over 760,000 pounds in the same area while burning less fuel to do that. To summarize, I estimate our carbon footprint per unit of output has shrunk to less than half of what it was in the 1970s. This huge feat has been accomplished thanks to plant scientists, farmers concerned with soil erosion and profitability, plus good equipment engineers. The profit incentive is always an efficient force for change and it acts on all businesses. The search for profit encourages ambitious farmers to invest in new ideas and new technology to stay profitable while food products continue to fall in price over the long run. It’s not all good news, however. Some farmers are reverting to old methods as the fear of new technology is spread. Many organic farming methods revert to tillage to control weeds and some organic growers burn weeds with a propane flame as an alternative method of weed control. This is a topic for another day but just know, if you are starting to feel there is a lot of misinformation in personal finance, dig into food marketing. Maybe some of the information is written by the same people who think cows don’t pee?

It is worth noting, we do need to keep doing better. Fuel costs are big and reducing our environmental footprint is important. Just as the profit incentive guided farmers to switch from horses to steam power to diesel to minimum and zero tillage, new science and the profit incentive will guide us to more efficient means yet. Price signals and markets have guided us in the right direction for hundreds of years. Unfortunately, food and fuel are very political topics. Governments around the world confuse the markets a lot by messing with price signals. That is also a topic for another day. The bottom line, we need to be more efficient and we need to pollute less. Market economics has been the most effective tool for producing these good results. History has proven this.

Why I Invest in Oil & Gas, Occasionally

Oil and gas investing is tough. Because producers are price takers, that is, the price they receive for their products is based on the lowest production cost in the world, plus factors such as artificial supply reductions from OPEC (Organization of the Petroleum Exporting Countries), less freight costs to major importers. It is always difficult to know what price a producer will receive and what profit can be achieved. There are times when money can be made, however, and there are companies that are better at making money than others, of course. For those reasons, there are times to be selectively invested.

The ESG perspective on oil and gas is fuzzy. It is fine to say we should shut down our oil and gas production but if we all keep burning or using the stuff, someone will produce it and ship it to us. Some ESG fund managers, some politicians, and some of the public believe if Canada produces less petroleum, less will be consumed and we can feel we have done our part without doing the hard work of researching new energy solutions or the even harder work of consuming less.

Once again, ESG investing is hypocritical. The approach implies investing in petroleum production is bad, investing in companies which make or sell stuff made from petroleum is okay.

Examples of investments which are ESG okay include clothing producers and retailers such as Lululemon and Nike which make athletic wear – which is generally made of microfiber materials (which are polyesters) made from petroleum, Tesla which makes electric cars – which are full of petroleum based composites and plastics, and of course Walmart and Amazon which sell all kinds of things from running shoes to toys to food storage containers – all, to some extent, made from petro-chemicals. I find it a bit baffling this one degree of separation from oil to clothing or two degrees from oil to retailing throws off journalists, politicians, ESG fund managers.

The idea that investing in oil production is bad but investing in clothing production made from oil is good, makes me think about that Six Degrees of Kevin Bacon thing that bubbled up a bunch of years ago. Do you remember that? If not, there is a refresher on Wikipedia, here is the link:

Wasn’t this a whole thing, about twenty years ago? And people “got it”. Now it’s time to “get it” with our economy and ecology… things are related to things, even if there is some separation.

Petroleum is part of the solution to some of our problems. As I have noted a couple of times, composites used in cars, in the newest jet planes, in windmill turbine blades are made from petroleum-based products. These innovations help us burn less fuel. Combustion creates the pollution so burning less should be the goal; producing less petroleum locally is counterproductive. At the risk of making this a political website, part of the last sentence needs to be repeated: combustion creates pollution, production does not – on a net basis (because if you burn it, someone, somewhere will produce it).

What about natural gas?

More and more of the world is looking at burning natural gas in lieu of coal for heating and for electricity production and possibly for transportation purposes too. Natural gas attracts controversy as well. While it is true, natural gas combustion does create carbon dioxide, quantity matters. It is the quantity aspect where the picture is blurred, yes, again, arguments made without math or numbers means we don’t easily understand the significance.

As an illustration, one argument I have heard, “natural gas is not really cleaner than coal, it turns out.” That statement sounds crazy. I want to put my grade 12 chemistry education to work and show that natural gas is indisputably cleaner than coal. The simple exercise of comparing methane and coal molecules will get that job done. Good thing it is that easy!

Let’s start with a molecule of methane (natural gas). One carbon atom connected to four hydrogen = CH4 (see image, below). When this molecule is burned you create a lot of water and a little bit of carbon dioxide plus heat, of course. Because methane is only 1 fifth carbon and 4 fifths hydrogen, a small amount of carbon dioxide is produced when you burn it, and lots of water.

Pure coal is pure carbon meaning mainly CO2 is created when it is burned. There are a lot of types of coal. Some coal has hydrogen and sulphur atoms and will create other compounds when burning, including water and sulphur dioxide (which can result in acid rain). To keep this simple, let’s look at pure carbon coal = simply the “C” or “carbon atom.” When it burns it creates carbon dioxide and heat and really not much else.

The link below shows a comparison of energy produced per unit of carbon dioxide. That is for

those of you who don’t believe in my chemistry skills.

https://www.eia.gov/tools/faqs/faq.php?id=73&t=11

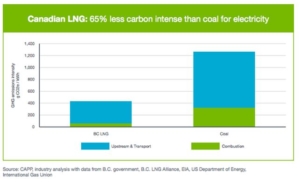

Below is a chart showing an overall carbon intensity comparison between coal and LNG (liquefied natural gas). Note, natural gas used locally in most of North America will have a lower carbon intensity yet since transportation is minimal and cooling or liquification, is not required.

Yes, you do use energy producing and transporting natural gas, as the chart above shows. You also have to dig, crush, clean and transport coal. The chart includes that comparison as well.

A secondary benefit of increased natural gas use, more demand is created for the product. As demand for natural gas increases, we see productive use of surplus gas or what they call associated gas. Without demand, that gas is typically flared off during oil production in many countries, especially over seas. Since this associated gas is a by-product of oil production, a lot gets produced whether they want it or not. This improved use of gas is confirmed by the World Bank: https://www.worldbank.org/en/news/press-release/2018/07/17/new-satellite-data-reveals-progress-global-gas-flaring-declined-in-2017

We do need to burn less fuel. And I get it, you probably can’t burn 100 million barrels per day of anything without having some effect on the world. Yeah, that is how much oil we burn worldwide. No, that’s not right, that’s how much we produce, a bunch of it is used to make stuff, as mentioned earlier. Even so, we burn a LOT. The trend to less consumption seems to be taking hold. Energy price increases do provide the market with an incentive to consume less. Again, consumption is a separate issue from production especially considering we (Canada) produce less than 5% of the world’s crude oil. The petroleum products we produce allow us participation in the chemical industry, allow us to create wealth to fund future research, provides Canada with the opportunity to participate in petroleum related environmental solutions such as possible hydrogen fuel solutions. One such example is that pursued by Proton Technologies of Calgary. Do keep in mind, this is unproven theory, I am not recommending this as an investment. The point is only to note, we are a player in the petroleum industry. Being a player provides us opportunities to find solutions which help our economy and the environment.

Why I Invest in Gold, Occasionally

I do invest in gold occasionally including miners, processors, and suppliers. To tell you the truth, I don’t fully understand why gold is a good investment. Sources I trust advise gold as a recommended investment in appropriate quantity, at present. I take that investing advice and further hedge my bets by mainly investing in low or no-debt gold companies that are value priced. Further, one of my holdings is really a gold processor, not so much a miner. During the Klondike, the big winners were apparently the pick-axe and gold pan sellers, not so much the actual miners, in many cases. That is the philosophy.

Factors that supports gold investing in 2019 include:

- Super low interest rates – since gold doesn’t generate a dividend, the opportunity cost is low

- Central bank buying – central banks such as China and Russia are trying to diversify away from U.S. dollars. This additional demand boosts gold prices

From a public protest point of view, where are the protests against gold and diamond mining, for that matter? Those activities have larger environmental footprints than petroleum production, relative to the utility of the product. This takes me back to the Six Degrees of Kevin Bacon. People get that but they don’t get that gold mining is just one or two degrees of separation from fuel consumption? Maybe I better explain that a bit.

A high-grade gold mine crushes a tonne of rock for every 30 grams of gold produced. A tonne… that is 60,000,000 grams of rock for every 30 grams of gold! After mining, you have transport, processing, and then more transport. Imagine the petroleum consumption required for all those processes. Like I said, one or two degrees of separation!

I won’t claim all ESG investing ignores these activities but so far I have not noticed much attention paid to gold, diamonds, crypto currencies. At the same time, many focus on fossil fuel production, a lot on beef production. That de-legitimizes the ESG concept further.

I invest in Gold when I believe I can profit from it despite its lack of practical use and its controversial footprint. I have to face the fact, my purchases just don’t matter to overall demand. Maybe that is a weak argument. It is simply the truth. Further, there are rare times, but important times, when no other security will serve the purpose that gold serves. One of those times is now. Besides, in the same way that demand drives the production of gold, just as demand drives the production of oil (or cocaine, or Labrador Retrievers, for that matter), my investment in gold is not affecting demand.

Oh, and why not own Bitcoin instead? Since this is an ESG driven discussion, let’s start by noting, one estimate of the energy requirement for one Bitcoin transaction is 1000 times higher than that required for a Visa transaction. How does the energy required to create one Bitcoin compare to the energy to dig up a gram of gold? I haven’t worked that out but there is significant energy to produce either “product”. While I tend to agree gold is largely worthless for most practical purposes, history suggests it will retain some value. Bitcoin simply doesn’t have that kind of history on its side. Who is to say a smarter, more efficient virtual currency doesn’t come along and dilute Bitcoin? Who is to say governments don’t start to regulate crypto currencies and minimize the libertarian value? A final thing to think about, while a lot of younger people generate all kinds of wealth as innovators and entrepreneurs, a lot of older people hold a lot of wealth. I’ll place my bets on the older crowd’s preference for gold over Bitcoin or any crypto currency. When you are looking for safe places to store your money, I don’t think you hide it in an imaginary bubble!

ESG Is Not All Bad … so the Point of This Tab Is?

I have written a lot of words criticizing ESG investing, now a flip flop?! Of course not. To the extent ESG brings attention to important issues, GREAT! How a company treats the environment, society, and how the corporation is governed are all very important and all play a role in how the company will perform. It is how ESG is defined, how the analysis is completed and then how ESG is used for marketing rather than for improving finance, those are the problems.

ESG may prove worthy of respect as information becomes ever more available. People are able to learn more about risky corporate behaviour than in the past. No company that allows tailing dams to rupture, that abuse employees or local residents, is a good investment. Of course, if information is misunderstood or misrepresented, the opposite becomes true.

For ESG to make a positive impact the focus needs to begin with integrity and science and not get caught up in trends and politics, nor be motivated by marketing goals. I am not confident that will happen. I have more faith in the influence of consumers, good regulation, media attention, fundamental investment research all combined, in spite of the MANY flaws each of these influencers have. Other cases where we have relied on experts to protect us, did not end well. A case in point is the 2007 – 2008 U.S. mortgage market collapse which spawned the Great Recession. A summary below of the role credit rating agencies, namely: Standard & Poor’s, Moody’s and Fitch Group had in causing that hardship, is taken from Wikipedia:

The Financial Crisis Inquiry Commission (FCIC)3 set up by the US Congress and President to investigate the causes of the crisis, and publisher of the Financial Crisis Inquiry Report (FCIR), concluded that the “failures” of the Big Three rating agencies were “essential cogs in the wheel of financial destruction” and “key enablers of the financial meltdown”.4 It went on to say: The mortgage-related securities at the heart of the crisis could not have been marketed and sold without their seal of approval. Investors relied on them, often blindly. In some cases, they were obligated to use them, or regulatory capital standards were hinged on them. This crisis could not have happened without the rating agencies.

Their ratings helped the market soar and their downgrades through 2007 and 2008 wreaked havoc across markets and firms.6

Think of the credit rating agencies as the ESG of credit risk. This should serve as a recent and powerful example of the danger of relying on elite, establishment guidance on issues of risk and proper conduct.

Will the ESG rating agencies do a better job of informing us than the credit rating agencies? Why would we think they will?

If you find it hard to believe all these respectable, successful ESG investment firms are leading you astray, let us bring in the egg heads for confirmation. Ira Yeung, assistant professor of accounting at the University of British Columbia’s Saunder School of Business has co-authored research that shows investors are drawn to corporate social responsibility but only for a short while and then the positive effect wears off. Further, his research shows, the positive impact occurs when society is paying more attention to these issues, such as now, he says. As with all things investing, past performance is not an effective predictor of future performance (my reminder). Additional work by French researchers found that when stocks were added to the Dow Jones Sustainability Index they did experience a price pop, within a decade the markets no longer cared.5

But again, actually caring about important issues is not bad. Maybe, again, the consumer is ultimately a more powerful change agent. One of the world’s smartest consumer products company must believe so. Unilever which owns brands: Dove, Axe, Vaseline, Popsicle, Ben & Jerry’s and dozens more, claim to be focused on measures which shrink the environmental impact of their products. By shrinking the packaging content of some products8, they have reduced Unilever’s costs while adding a positive feature to their product. In turn, it is possible their revenue, profitability and share price should increase. I can buy into that. This is an example of transparent and logical change the consumer and investor can see. We won’t need Dr. ESG to provide the assessment for us.

That has to be enough said about ESG, by me at least. It is easy to be against things, that is not the point. The real point is, the world is a tough place. As much as we live in luxury compared with most humans in all of history, behind the scenes the fight for survival continues. When the antelope outruns the lion, he lives another day; when the lion outruns the antelope, she feeds her cubs and they live another day. That is the world we invest in. The second the market believed Apple had the smart phone technology of tomorrow, BlackBerry shares began their fall. The market didn’t care about shareholder losses or job losses, the world moved on. It is that same market you are investing in. The highest ESG rating in the world won’t help if the market decides the star ETF of 2020 is suddenly the BlackBerry of 2011 or is the slow antelope of the day, share prices / ETF prices collapse fast when the market sours on expected future profitability. Similarly, no one cares about your money as much as you do so take care of you, when you invest. That gives you the ability to do good things with your profits. Just like the Greedy Farmer, only if you harvest a crop, can you plant the seeds that create next year’s green shoots.

—————————————————————————————–

The fine print. I chose a “fine” font for the following paragraphs since this is the “fine” print. I want my fine print to be as legible as any content on the website. Investing is about paying more attention to the fine print than the headlines. Further, fine print is written because it matters, shouldn’t you be able to see it?

Above, where I write, “our farm’s carbon footprint has shrunk to less than 50% of what it was when I was a kid”, that conservative calculation comes from my own first-hand knowledge. I know very well that our production has more than doubled, per unit area. The exact amount of the reduction of fuel burned per square mile, I do not know as accurately, I just know it is significantly less. Tillage, working the land, cultivation, whatever term you use for cutting through the soil to create a seed bed or to cut off a weed root, requires a lot of power. Power requires fuel combustion. Changing to a process of seeding directly into the undisturbed land instead of cutting through the land multiple times, has minimized the fuel burn dramatically. So, add that to other minimum tillage procedures, I feel quite confident of reduced fuel burn. Add that savings to improved efficiencies from equipment modernization. These carbon savings will be offset by some increase in the use of fertilizer.

As with all claims I make in my content, I will continue to do my homework and review new information. Further, I will continue to scrutinize the references I have quoted. I want to do my best to understand and present factually accurate information. Most important, I want the best information I can find to make investment decisions. Any researched and well considered feedback is welcome.

Speaking of research, I know it is easy to cherry-pick data. There are opposing theories with every debate, it is easy to find one that fits a pre-established position. I try my best to avoid this pitfall. Skilled presenters and writers can make false information as convincing as true information. Some of the best presenters are more apt to be fibbers or “snake oil” salesmen, after all, their product is their presentation. It takes a lot of work and a healthy dose of skepticism to sort the wheat from the chaff. The world is a complicated place, we only know what we know until we know better!

3 the ten-member commission appointed by the United States government with the goal of investigating the causes of the financial crisis of 2007–2010

4 FINANCIAL CRISIS INQUIRY COMMISSION Final Report-Conclusions-January 2011

5 Report on Business, October 2019 edition, The Globe and Mail

6Report on Business, October 2019 edition, The Globe and Mail

7 Greedy Farmer Investing, as published right here and now, 06 November 2019